Historically produced for the manufacture of coconut oil (from copra, which is dried coconut flesh) and desiccated coconut, the coconut is a ubiquitous palm species (Cocos nucifera ) well distributed across the tropical belt. Cultivations of the palms extend to perhaps more than 12 million hectares with annual production estimated at some 75 billion nuts (62m mt). Since the beginning of this century, the rapid growth in demand for coconut water has seen a revival of interest in the crop for commercial agriculture.

In many parts of the tropical belt, the small farmers or harvesters who supply coconuts to consumers or processors may receive as little as US$0.02 per nut at the farm gate. Yet the value of processed or semi-processed coconut commodities is estimated at some $10.5bn pa (Vinay Chand Associates).

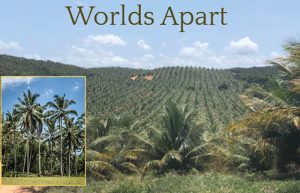

Whereas traditional smallholder farmers account for some 95% of the global production of coconuts, resulting in relatively low yields per ha as indicated by the national averages in the table above, commercial farms with high density planting configurations of between 160-300 palms per ha, claim to be able to produce more than 20 mt/ha. High yielding hybrid varieties (typically crosses between dwarf and tall varieties) are preferred for commercial plantations.

Vinay Chand Associates notes that the coconut sector has been under investing in processing facilities for much of the past 25 years. Now that there appears to be a sustainable upsurge in demand for coconut related products (in particular coconut water, coconut milk derived products and rubberized coir), there is growing interest in investment into the segment.

The higher value coconut products (listed below) have been enjoying robust market growth and yet supply is constrained by a lack of processing capacity at source.

- green coconut water

- mature coconut water

- virgin coconut oil (VCO)

- rubberised coir

- coconut sugar is a new niche market that is attracting interest from food brands and investors.